Generative AI fraud encompasses various malicious activities in which artificial intelligence(AI) models are exploited to generate counterfeit content. This includes fabricated text, images, or voices that are subsequently employed for fraud, such as impersonation, identity theft, or manipulating individuals.

From 2020 to 2023, data breaches in the U.S. increased by 157%, and 1 in 7 newly created digital accounts are suspected to be fraudulent, with $3.1 Billion left exposed to synthetic ID fraud attacks. Thus, digital facial recognition solutions are essential for financial institutions to prevent identity theft and other financial fraud.

This article will delve into the core of facial recognition technology, and it ensures security for digital finances.

Key Insights of the Article

- Comprehending biometric face recognition

- The diversified face recognition process

- The core face recognition deep learning

- AI face recognition online for banking and fintech apps

- Face recognition solution to dissuade Identity fraud

What is Biometric Face Recognition?

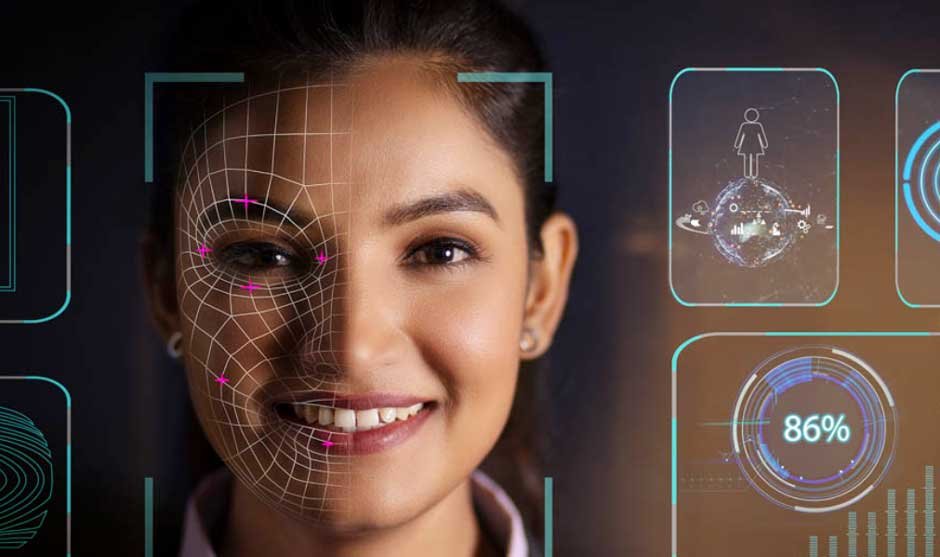

A biometric face recognition approach is an advanced method of ascertaining an individual’s identity using their unique physiological characteristics. The process involves creating a biometric template of a person’s face from an image or video frame, which identifies distinctive features. This template is then compared to existing templates, available in a database to find a match.

The use of digital photos and video stills is becoming increasingly popular, with new applications constantly being developed. This technology allows for easier identification of specific individuals and faces. Simultaneously, the matching software and algorithms are improving due to the availability of more data sources and increased accuracy.

The Optimal Face Recognition Process

The face recognition process transpired by advanced artificial intelligence is a modern technology based on a specific convolutional neural network and machine learning. To match the face, the system observes the following process:

Face Detection: It is the initial step in which the face is detected from an image or a video. This step involves locating the face, finding it, and aligning it for the next step.

Face Analysis: The system analyzes facial features once a face is detected and aligned. This analyzes the distance between the eyes, the shape of the jawline, and the contours of the cheekbones, lips, and nose.

Feature Extraction: The facial features are extracted from the analyzed face to create the faceprint, biometric templates, and digital face code.

Face Comparison: These face codes and templates are compared against a database of available faces. Then the final results are then provided, indicating whether it’s a match.

Face Recognition Deep Learning and CNN

Face recognition solutions incorporate deep learning technology, a subset of machine learning. It also embeds convolutional neural networks (CNN), which are fundamental in recognizing new inputs. With advanced AI and intelligent algorithms, it filters the data to give the optimal results.

A convolutional neural network converts every face pattern into a numerical code, describing every template as a numerical vector. The closer two vectors are to each other, the more likely they will have a face matching online. In this designed and profound way, face recognition deep learning enhances the accuracy and speed of the whole process.

Revolutionize Security with AI Face Recognition Online

As in the ever-evolving world, security is sometimes compromised due to digitalization and continuous technological revolutions. This increases the demand for robust security to sustain the integrity of financial organizations and protect customers’ interests. The ingrained security can uphold prevalent and proactive threats of identity theft and fraudulent scams that can lead to money loss and economic instability.

AI face recognition online can be implemented in several industries to upscale and protect them from distinctive frauds. Such as,

Banking and Financial Services

- Customer Authentication

- Fraud Detection

Retail and E-commerce

- Personalized Shopping Experience

- Theft Prevention

Healthcare

- Patient Identification

- Access Control

Transportation

- Airport Security

- Ridesharing

Education

- Exam Proctoring

- Campus Security

- Attendance Tracking

Hospitality

- Guest Identification

- Loyalty Programs

- Security

Law Enforcement and Security

- Criminal Identification

- Access Control

Entertainment and Sports

- Stadium Security

- VIP Services

- Fraud Prevention

Real Estate

- Smart Homes

- Tenant Verification

- Property Access

Facial Recognition Solution For Enhancing Fintech and Banking Industries

Financial institutions like fintech and banks require regulatory compliance to secure systems and prevent hefty fines from legal bodies. These institutions are obliged to integrate KYC and AML processes to know who they are dealing with and if the person is legitimate or not. They ensure the credibility and the character of the customer before providing them access to their system.

Thus, face recognition solutions are needed for financial institutions while onboarding customers and, after that, whenever they are accessing their accounts. The technology has multifaceted purposes that are beyond identity verification. It is prevalent in authorizing access and detecting suspicious activities that can be indigenous and expatriate frauds.

Final Statement

In today’s digital age, robust facial recognition solutions are critical for securing industries against fraud. Advanced AI and deep learning enhance accuracy and efficiency in identity verification which provides proactive defense against fraudulent activities. Financial institutions must adopt these solutions to meet regulatory requirements and protect customer interests. Embracing facial recognition technology is essential for a secure digital future.